Every pet parent’s worst nightmare is being unable to help if their furry friend gets sick or injured unexpectedly. Send Veterinarians witness pet parents making the agonizing choice between paying for care they can’t afford and seeking alternative (and usually less effective) treatments every day.

With veterinary care being the second highest annual pet-related expense people face, according to the American Pet Products Association, more and more are turning to pet insurance for financial peace of mind.

But with more than a dozen providers in the market, picking the right pet insurance can be daunting. What types of pet insurance are there? What does pet insurance typically cover? What should you ask before buying a policy?

Types of pet insurance for paw parents

Accident-only

As the name suggests, this is the most basic type of pet insurance and only covers treatment for injuries and accidents. Things like sterilization, deworming, vaccinations, and regular vet visits will need to be covered by you out of pocket.

This is the most affordable form of pet insurance but the most basic one.

Accident and illness

Accident and illness pet insurance will cover accidental injury and any illnesses and diseases your pet may contract. This includes infectious diseases, and hereditary skin, ear, and eye conditions.

This might be a good option if you own a pet that is likely to experience health conditions. Make sure to read the fine print on these policies to make certain the conditions you’re concerned about are, in fact, covered and if any limits apply to specific breeds.

Comprehensive

Consider this the Rolls Royce of pet insurance options. The costs for this type of insurance are higher than other types of pet insurance.

This type of insurance will include accident and illness cover as well as cover for routine care. These types of insurance sometimes also include things like sterilization, vaccinations, tick and flea control, deworming, and microchipping.

And as good as that all sounds, there are some exclusions. Pre-existing conditions and more complex treatments and surgeries are not typically covered. If you have specific concerns or your pet needs particular treatment, check the exclusions and limits that might apply.

Read more: 7 Critical Signs Your Pet Needs Immediate Veterinary Attention

What does pet insurance typically cover?

A good value plan will include coverage for hereditary and chronic conditions as standard, so there’s no need to purchase add-ons to basic coverage. Options to buy things like hip dysplasia riders or coverage for chronic diseases like cancer or diabetes should raise a red flag.

Chronic conditions should also be covered into old age; some companies cover chronic conditions initially and then exclude the condition as pre-existing during the next policy term. A good policy covers chronic conditions for life.

Basic insurance plans won’t include preventative treatment like teeth cleaning, prescription foods, vaccinations, and sterilizations. Prescription foods are usually also not covered. Not all insurance companies will cover all medication. Some have a list of meds they’ll pay for.

Limits on various health conditions

Some providers use a benefit schedule to determine how much they will pay for a specific condition. This is often a source of dissatisfaction from pet parents. Say a company pays up to $395 for an allergic reaction, but a pet’s reaction requires a hospital stay and fluid therapy that costs $1,500.

A benefit schedule plan will reimburse $395, regardless of complications that arise or additional treatments needed to resolve the condition. A provider compensating based on actual veterinary fees will cover the entire bill (minus the deductible and optional co-pay).

The sky is not always the limit. At least not where pet insurance is concerned. Make sure that before you sign on the dotted line, you check what the limits are on your chosen plan. There may be limits to in-room care or specific treatments.

Some companies may offer support for some conditions and cap it at a certain amount. Check the fine print here, especially for conditions that affect certain breeds, like respiratory conditions in pugs and periodontal disease in small to medium dog breeds.

Pre-existing conditions

Pre-existing conditions are rarely covered by pet insurance. Pet parents simply can’t receive a cancer diagnosis and then go out and buy a pet insurance policy to pay for the treatments.

There are, however, insurance providers who distinguish between curable and incurable conditions – reinstating coverage for curable conditions, like a urinary tract infection, after a certain amount of time passes with no recurrence. Pet parents should ask about this before buying coverage.

Things to keep in mind

Not all pet insurance companies are created equal. Plans can vary wildly, with some being straightforward and others having plenty of conditions and add-ons. It can sometimes feel like a minefield, but hopefully, we can offer some handy advice.

For example, does the insurance provider pay the vet directly, or do you need to pay out of pocket and submit a claim later?

So here are some questions to ask when choosing pet insurance:

- Are you restricted to a network of approved veterinarians? Or can you choose your own?

- Is there a waiting period before treatment is covered?

- What treatments and services are covered? Which are not?

- Do premiums increase along with the age of your pet?

- What is the co-payment rate? What deductibles are there?

- Do they offer discounts for multiple pets?

- What are the conditions for cover? Are you required to take your pet for annual exams to maintain coverage?

- Does the pet insurance cover pre-existing conditions?

- Is preauthorization required for visits and treatment?

- Are there annual maximum benefits or benefit ceilings?

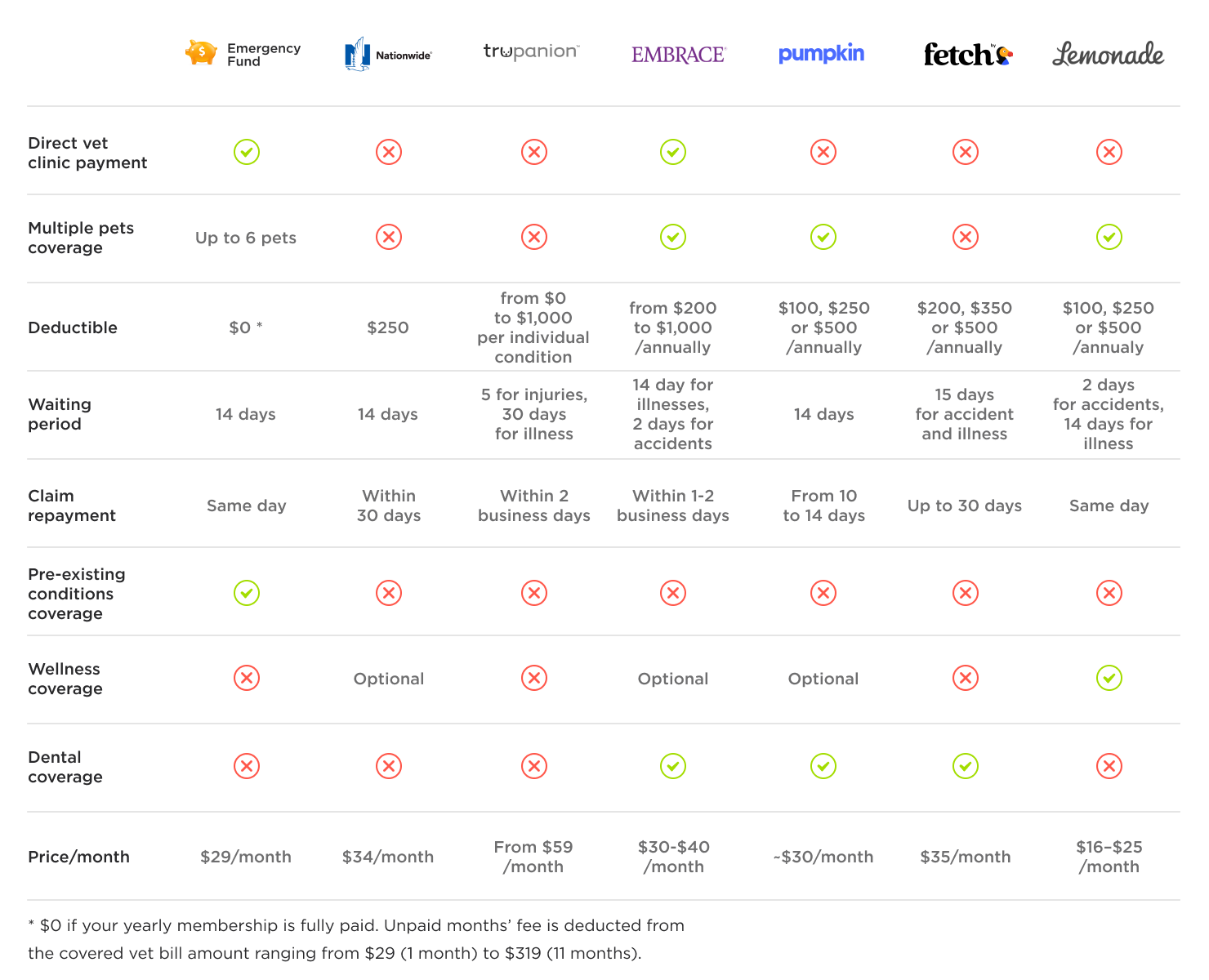

Comparison Infographic

Emergency Fund by Petcube

For the pet pawrent who is looking for emergency cover only, Emergency Fund by Petcube is an affordable and convenient alternative. This kind of plan will ensure that your pet has access to emergency veterinary care in the event of a life-threatening injury or illness.

For just $29 a month, you have 24/7 access to a team of trained veterinarians who are just a chat away. If you’re concerned about your pet, send a chat to the team, and they will assess the situation.

They’ll require as much information as you can give and sometimes even a video of your pet to properly assess the severity of the situation. If the online vet feels it’s a life-threatening emergency, you can visit any vet for treatment and know that you have access to up to $3000 for this life-saving care.

Emergency Fund does not cover day-to-day care, preventative treatments, or any non-life-threatening problem.

FAQ

Pet insurance pros and cons?

The pros of having pet insurance include:

- Peace of mind knowing your pet will be cared for;

- Insurance often covers more expensive therapies and treatments;

- There are plenty of plan options to ensure you can find something that you can afford and that covers you.

The cons of pet insurance:

- Breed-specific conditions might not be covered;

- Pre-existing conditions might not be covered;

- Cancellation fees and waiting periods may apply;

- Policies may limit cover as your pet ages, or cover may become more expensive;

- Some policies might require you to use their network of veterinarians or pay an out-of-network fee;

- Premiums may be more than what you currently are paying for vet care.

Does pet insurance cover neutering/spaying?

Many pet insurance plans don’t cover preventative care like spaying and neutering. More premium plans may cover this, but you’d need to check specifically.

Does pet insurance cover vaccinations?

Vaccines are preventative care and often fall outside the scope of most pet insurance plans. It’s important to mention that treatment for pet illnesses for which there is a vaccine is frequently not covered if your pet is unvaccinated.

What is a deductible in pet insurance?

Like in car and human health insurance, you contribute a monthly premium but are also liable to cover the deductible or co-payment when you make a claim.

The size of the deductible will impact the size of your premium. So, a lower deductible will result in a higher monthly premium, whereas a higher deductible will result in a lower premium.

There are two types of deductibles in pet insurance. An annual deductible is paid only once yearly and is a much simpler solution to understand and manage. It doesn’t matter how often your pet visits the vet; you still only pay once per year.

The second type of deductible is the per-incident deductible. This is applied every time your pet goes to the vet. This type of deductible can get expensive very quickly.

You can seek a plan that doesn’t have a deductible, but this will mean a higher monthly premium.

How does pet insurance know about pre-existing conditions?

Your prospective insurance company will review your pet’s medical records and sometimes require the vet to perform an exam to identify any existing conditions.

Best pet insurance for a French bulldog?

French bulldogs often develop respiratory conditions because of their flattish faces, so you’ll need to ensure that any insurance you take for your Frenchie covers this and doesn’t have any limits for this breed.

Does pet insurance cover surgeries?

Most pet insurance plans, even the basic ones, should cover in-hospital care and care post-op (follow-up visits, etc).

Pet insurance vs. wellness plan – what’s the difference?

The easiest way to explain the difference is that pet insurance is designed to cover the unexpected – like accidents and illness. In contrast, a wellness plan covers routine care like teeth cleaning and vaccinations.

Does pet insurance cover prescription food?

Typically, prescription food is not covered by many basic plans. Some of the more premium plans might include this.

Does pet insurance cover euthanasia?

Not all pet insurance plans cover euthanasia or end-of-life costs.

Was this article helpful?

Help us make our articles even better